41+ if filing separately who claims mortgage

Web Married Filing Separately. Web When you file a joint return you and your spouse will get the married filing jointly standard deduction of 25900 1400 for each spouse 65 or older You are.

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

Ad Highest Satisfaction for Mortgage Origination.

. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Increasing Mortgage Payments Could Help You Save on Interest. Ad Start a Legal Chat with a Certified Lawyer Now.

Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. Web However if your AGI was 40000 and you filed separately you could deduct any medical expenses over 3000. Talk to a Certified Lawyer Online Now.

Web If you and your spouse file separate returns and one of you itemizes deductions the other spouse must also itemize because in this case the standard. Web If you are married and filing separately both you and your spouse can each deduct the interest you pay on 500000 worth of a mortgage loan. A filing status for married couples who choose to record their respective incomes exemptions and deductions on separate tax returns.

Get Reliable Real Estate Law Info in Minutes. That extra 4500 in deductions could make filing separately the. The 35 tax bracket covers more income for.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The married-filing-separately brackets are the same as those that apply to single taxpayers with one major exception. Get Reliable Info Online.

Save Real Money Today. Apply Online To Enjoy A Service. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

If for example you have a.

Pdf Automatic Identification Of Topic Tags From Texts Based On Expansion Extraction Approach Edward Fox Academia Edu

Proof Of Income Letter Examples 13 In Pdf Examples

Calameo Sifferman V Sifferman 04 3 02210 1 Casefile Part 3

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Business Succession Planning And Exit Strategies For The Closely Held

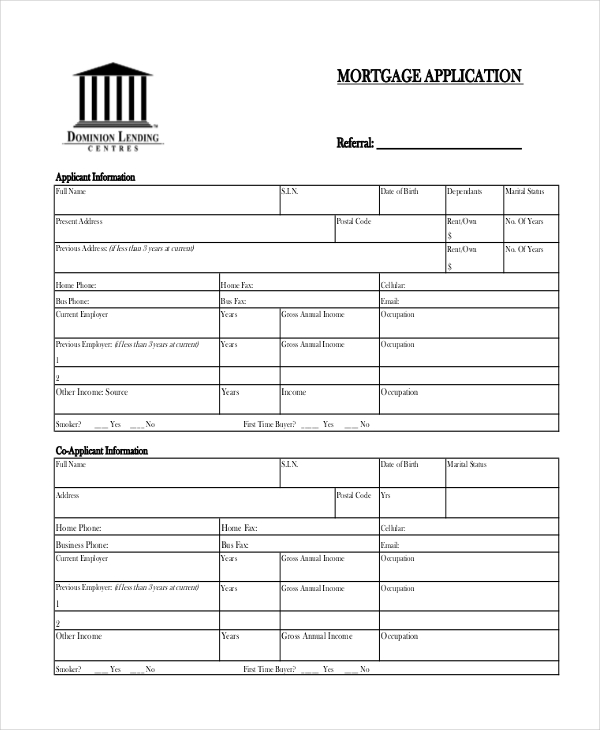

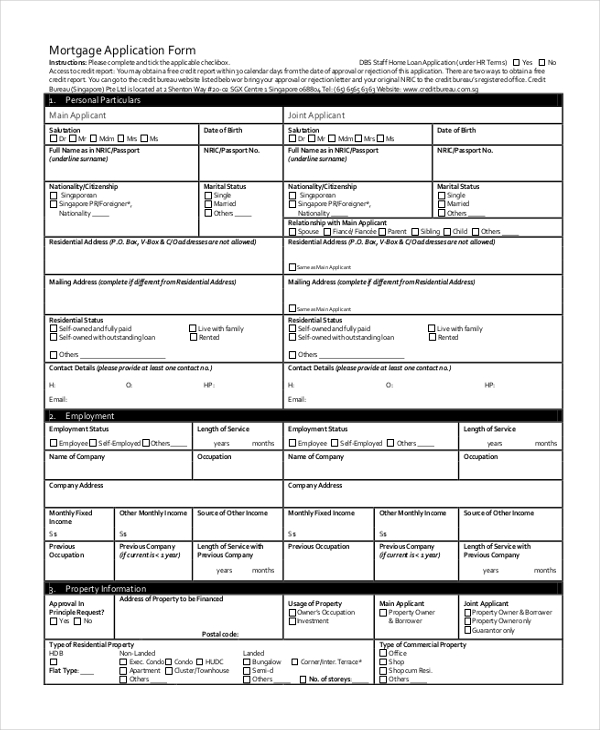

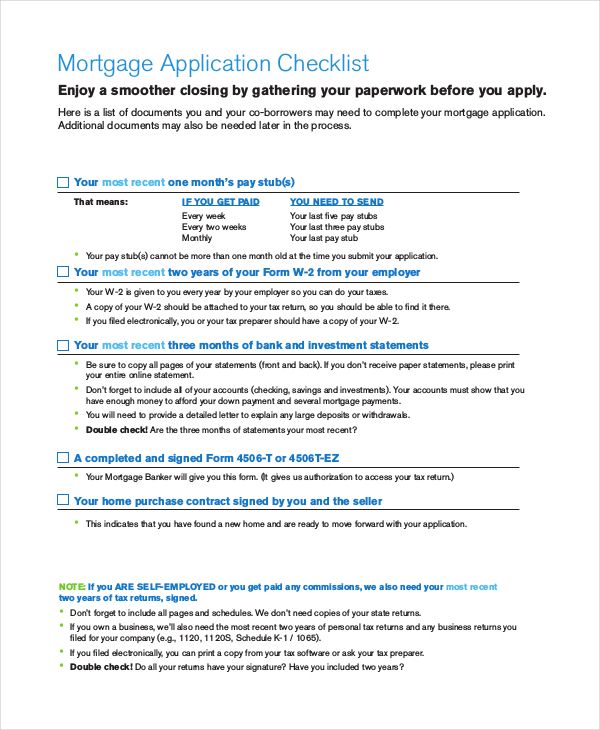

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

No 05 3 02755 1 Andrew Rife V Jennifer Rife Aka Lesourd Nka Mehaddi Pdf Arbitration Child Support

Drs A

Irs Increases Marriage Penalty Unmarried Cohabitants To Get Twice The Mortgage Interest Deduction

The Iola Register June 3 2020 By Iola Register Issuu

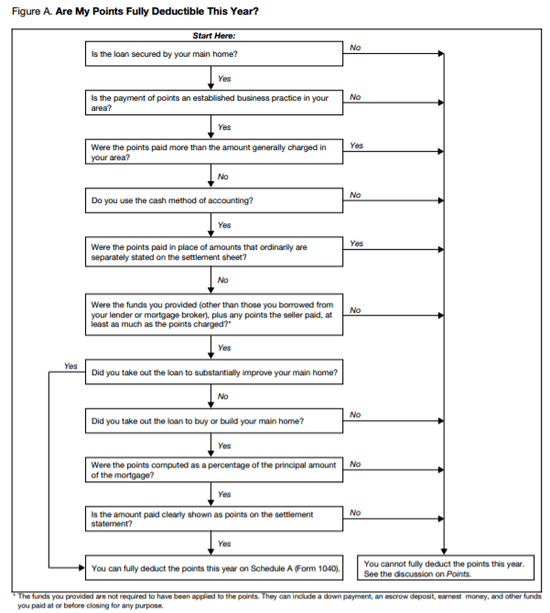

How To Deduct Home Mortgage Interest When Filing Separately

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

What To Do With Tax Refund Smartest Ways To Spend Your Tax Refund

Avoiding Surprises How Marriage And Tax Filing Status Impacts Your Federal Student Loans How To Money

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

How To Deduct Home Mortgage Interest When Filing Separately

Intouchjan Feb2016 By Into Issuu